Q3

2023

Letter of the CFO

Dear Limited Partners,

I am pleased to present you with our Q3 financial statements and the key performance indicators (KPIs) for our portfolio, featuring Encellin as this quarter’s highlight.

Despite the continuing economy and VC industry trends we saw in Q1 and Q2 this year, we have witnessed a commendable positive momentum and stability across our portfolio, as evidenced by multiple successful capital raises and positive operational metrics in most companies. We continued to prioritize entrepreneurs in our daily schedules, ensuring that when a founder faces an urgent need, we promptly allocate our time to address those.

The runways and performance of the portfolio remain positive, with a MOIC of 1.16x, and 11 out of 19 companies have raised capital with priced markups or SAFEs with cap increases since our investments were made.

We are extremely proud of what our founders have been able to accomplish so far, and are very optimistic about the opportunities for our portfolio companies in Q4 and 2024.

With most of our portfolio companies successfully reaching their 2023 milestones and closing their fundraising rounds, we can now reallocate time to raising Fund III. These efforts paid dividends with Consuelo, our founder and managing partner, being selected amongst the top 20 VC funds (amongst a pool of over 700 applicants) to present at the prestigious 2023 RAISE Global in front of top global LPs in the asset class. Consuelo’s presentation of how her values align with our fund and our founders resonated in a very strong way with attendees, and we have received incredible feedback and interest from LPs in our newest fund.

We welcome you to view the 5 minute pitch below:

From a wider VC industry perspective, the trend that we have seen for the past 12-16 months has continued. IPOs and exits in Q3 did increase from the previous few quarters led by large IPOs of Instacart and Klaviyo, but with a $51.5B of exit value as of Q3 2023, the total exit value would be in line with 2022, and the lowest since 2016 (Pitchbook). Projected exits for companies this year stand at 752, the lowest since 2013. Nevertheless, the large IPOs of Instacart and Klaviyo have boosted the total exit value. The performance of these large IPOs was also weak, with Instacart’s post-money valuation of $8.3B and Klaviyo’s of $9.5B, well short of their latest private rounds of $39B and $9.5B, respectively (Pitchbook).

The lack of liquidity and weak performance in the IPO and M&A markets for late-stage companies continues to reverb through late-stage rounds, with 18% of total capital raises being down rounds. While an improvement from 19.5% in Q1 and Q2 2023, down rounds still remain at very high levels (Carta). Bridge rounds, an indicator of capital being raised without companies being able to raise fully priced rounds, also remain elevated at 36% of all capital raises (Carta). The clearest indicator of the lack of liquidity available for startups is the time between capital raises. Currently, the median time, which is now about two years between Seed and Series A rounds and also between Series A and B, extends to two and a half years between Series B and C (Carta).

This new norm of difficult access to capital compels us to consistently advise our founders to operate under the assumption that a series A capital raise will take from one to two years. They should plan their cost structures and funding strategies accordingly. In the pre-seed and seed stages, where our sourcing and investing efforts are concentrated, we have observed two key trends. Firstly, valuations have remained at similar levels; secondly, although activity has decreased, the decline is not as drastic as it is with later-stage companies. (Pitchbook).

Large societal problems persist, offering opportunities for passionate and innovative entrepreneurs to solve them. Our role in finding and supporting these entrepreneurs is crucial to solving these problems and presents the opportunity for outsized returns.

Thank you for all the support and reach out to either me or Consuelo with any questions or feedback.

Vartan Indjeian,

CFO, Endurance28

Key Metrics

Headline Statistics

Portfolio Runway

Portfolio Snapshot

Number of companies

5

2

6

1

2

3

19

Financial Statements

Founder Highlights

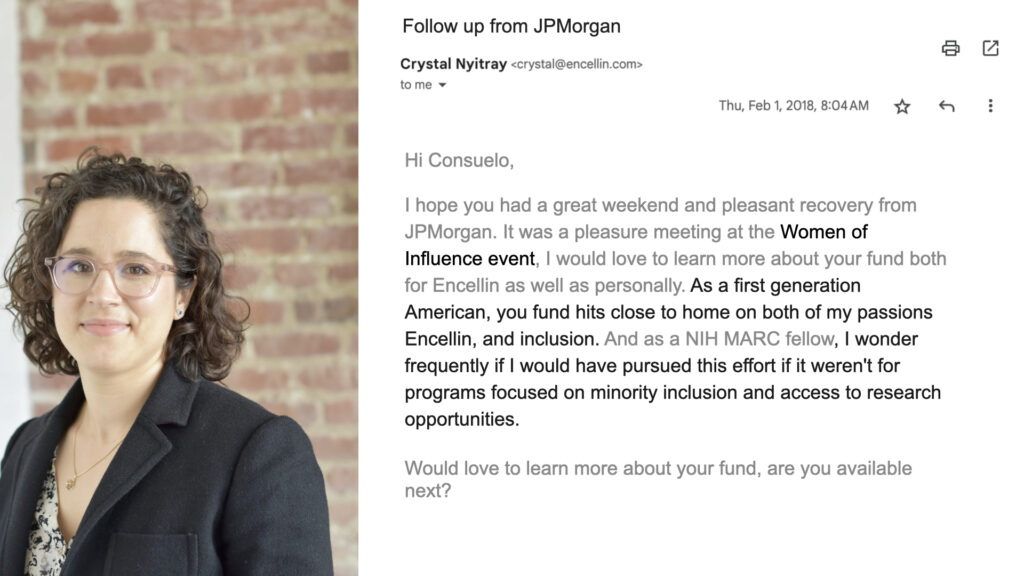

Crystal Nyitray and Grace Wei, founders of Encellin, are revolutionizing medicine, turning cells into smart molecular factories.

But their journey is not just about scientific innovation, It’s also about endurance and overcoming adversity. Despite their impressive academic backgrounds, they faced rejection from status quo VCs.

After meeting Crystal at a Women in Life Sciences event, her vision, struggle, and determination, resonated with me, having repeatedly been told I needed a male partner to raise a fund.

We led their seed round, and now the tides are turning. Encellin is starting first-in-human clinical trials in patients with type 1 diabetes. Khosla invested, and Encellin caught the attention of Bill Gates.

The concept for Encellin originated while Crystal was pursuing her PhD in Pharmaceutical Chemistry at UCSF. She approached the Chair of Bioengineering with a novel idea: to not only provide the correct dosage of medication to patients but also to assist in keeping cells alive within the body.

Crystal’s expertise in the engineering aspects of these processes was perfectly complemented by Grace’s background as a biologist. Grace possesses both technical expertise and a deep understanding of cellular complexities. Together, they have been able to innovate in transformative ways that would not have been possible individually.

I go for a run. I do my best to get out into nature as much as I can and just really have an opportunity to experience gratitude in my physical being and my health.

– Crystal Nyitray, Ph.D., CEO, Encellin